Cash flow is the lifeblood of any small business. Without proper cash flow management, businesses can struggle to cover expenses, pay employees, and invest in growth opportunities. Unfortunately, cash flow challenges are one of the most common financial issues small businesses face, and they often lead to operational struggles, decreased profitability, and even business closures.

In this article, we’ll discuss the common cash flow management challenges small businesses experience and provide practical solutions to overcome these obstacles. Furthermore, we’ll explain how integrating accounting services, bookkeeping services, and tax planning services can help alleviate these challenges, ultimately improving your business’s financial health.

If you’ve previously dealt with marketing strategy difficulties, you may already understand how cash flow issues can affect the execution of marketing campaigns and employee retention strategies. Efficient cash flow management is crucial for addressing these and ensuring long-term business success.

Common Cash Flow Management Challenges for Small Businesses

While every small business is unique, several recurring cash flow management challenges are common across industries. Identifying these obstacles early is the first step to ensuring a business can weather financial challenges without sacrificing growth potential.

1. Inconsistent Cash Flow

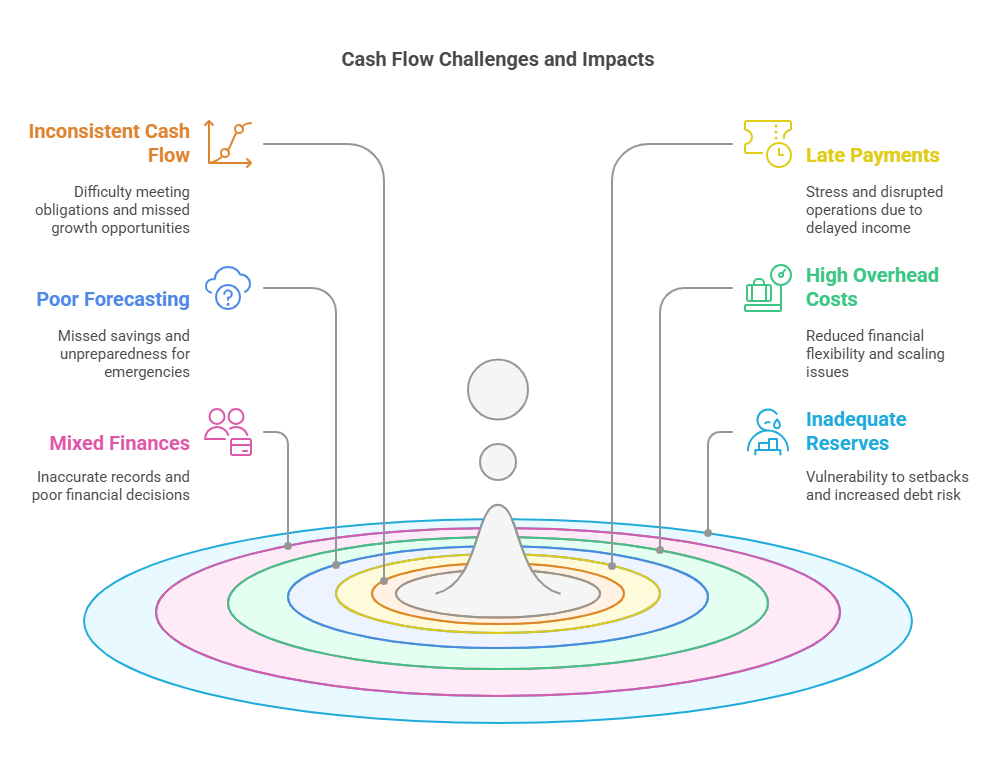

One of the most significant challenges small businesses face is irregular cash flow. For businesses that rely on sales or client payments, the timing of cash inflows often fluctuates. Seasonality, delayed payments from customers, and unexpected expenses can all contribute to inconsistent cash flow.

Impact on the Business:

Inconsistent cash flow can make it difficult to meet regular financial obligations, such as paying bills or employees on time. It can also lead to missed growth opportunities, as businesses may be unable to invest in new projects or initiatives due to cash flow gaps.

2. Late Payments from Clients

Late payments from clients can create significant cash flow issues, particularly for small businesses with limited financial resources. Businesses often have to wait for overdue invoices to be paid before they can cover operational costs, and this delay can hurt their ability to function smoothly.

Impact on the Business:

Late payments can cause stress for small businesses as they scramble to meet financial obligations. This disrupts operations and may force businesses to delay important decisions or investments. Furthermore, depending on customer relationships, late payments can damage client trust and harm long-term partnerships.

3. Poor Financial Forecasting and Planning

Accurate financial forecasting is critical for cash flow management. Many small businesses struggle to forecast cash flow effectively due to a lack of financial data, poor record-keeping, or ineffective financial systems. Without accurate forecasts, businesses may find themselves underprepared for fluctuations in cash flow or unforeseen expenses.

Impact on the Business:

Without proper forecasting and planning, businesses may miss opportunities to save or invest when cash is available. They may also struggle to handle emergencies, such as unexpected expenses or drops in sales, leaving them unprepared for cash flow gaps.

4. High Overhead Costs

Small businesses with high overhead costs often find it difficult to maintain healthy cash flow. Regular operating expenses, such as rent, utilities, and salaries, can put pressure on cash reserves, especially when sales are inconsistent or customer payments are delayed.

Impact on the Business:

High overhead costs reduce the flexibility a business has in managing its finances. Businesses may struggle to scale or pivot in response to market changes because they are tied to expensive fixed costs that don’t vary with revenue.

5. Inability to Separate Business and Personal Finances

Many small business owners mix their personal and business finances, which can complicate cash flow management. When business and personal expenses are intertwined, it becomes difficult to track the financial health of the business accurately and make informed decisions about spending and saving.

Impact on the Business:

Mixing personal and business finances can lead to inaccurate financial records and tax issues. This lack of separation can also cause the business owner to make decisions based on inaccurate cash flow data, affecting the ability to invest in the business’s future or cover essential expenses.

6. Inadequate Cash Reserves

Having a safety net in the form of cash reserves is essential for small businesses. However, many small businesses lack sufficient reserves, leaving them vulnerable to unexpected financial setbacks or emergencies.

Impact on the Business:

Without an adequate cash buffer, businesses are more likely to struggle when faced with unexpected costs or slower sales periods. This can lead to increased reliance on credit or loans, which can further strain cash flow and increase the risk of debt.

Solutions to Overcome Cash Flow Management Challenges

Now that we’ve covered some of the most common cash flow challenges small businesses face, let’s look at practical solutions that can help you manage your cash flow more effectively. These strategies are designed to minimize cash flow gaps, improve financial forecasting, and provide greater flexibility for your business.

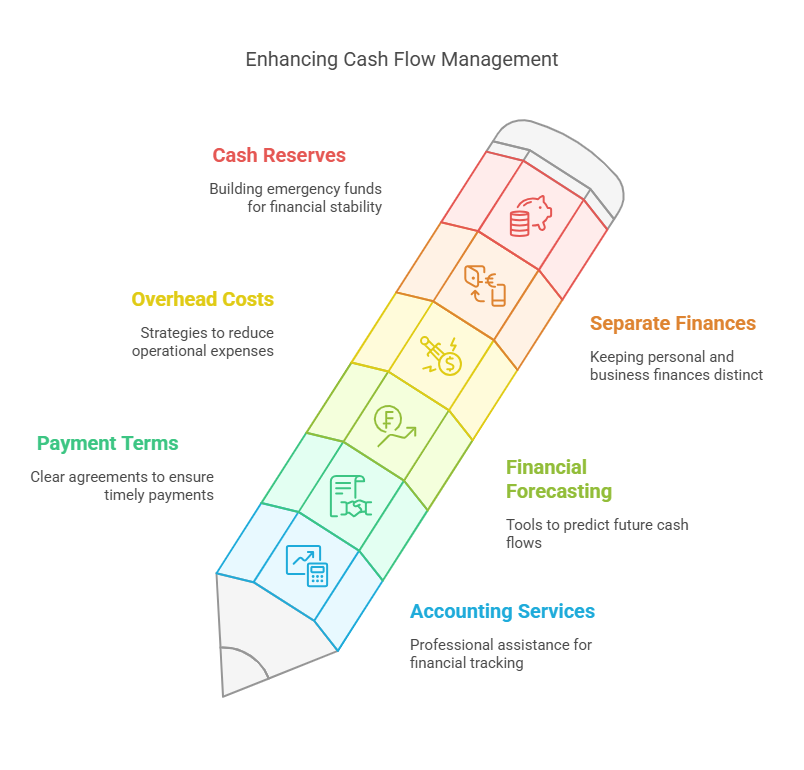

1. Use Accounting Services for Accurate Financial Tracking

Hiring an accounting service can significantly improve cash flow management. Accounting professionals can help small businesses track their financial records, create accurate cash flow statements, and identify trends that may impact cash flow. They also ensure that taxes are filed correctly and on time, reducing the likelihood of penalties that can affect cash flow.

Pro Tip:

Outsourcing accounting services enables you to focus on growing your business rather than worrying about bookkeeping. With accurate records, you’ll be able to make informed decisions on how to manage cash flow more effectively.

2. Set Clear Payment Terms and Follow Up on Late Invoices

To avoid cash flow problems caused by late payments, establish clear payment terms with clients from the outset. Be specific about payment deadlines, and enforce these deadlines consistently. If payments are overdue, follow up promptly and professionally to ensure timely payment.

Pro Tip:

Consider offering discounts for early payments or charging interest on late payments to encourage clients to pay on time. Clear communication about payment terms reduces confusion and helps maintain healthy cash flow.

3. Improve Financial Forecasting and Planning

Invest in financial forecasting and planning tools that help you project future cash flows based on sales forecasts, anticipated expenses, and seasonal fluctuations. Regularly review and update these projections to account for changes in the business environment, allowing you to stay on top of potential cash flow challenges.

Pro Tip:

Use bookkeeping services to generate real-time reports that help you understand the financial position of your business. By forecasting accurately, you’ll be better prepared for slow periods and more equipped to handle unexpected expenses.

4. Reduce Overhead Costs

Take a close look at your business’s overhead costs and look for areas where you can cut back or streamline operations. Whether it’s renegotiating supplier contracts, reducing utility expenses, or outsourcing non-essential tasks, reducing overhead can free up cash flow for more important investments.

Pro Tip:

By utilizing tax planning services, you may be able to identify potential savings opportunities in areas such as deductions or credits. Lowering your tax burden can directly improve cash flow and leave more money available for reinvestment in your business.

5. Separate Personal and Business Finances

One of the best ways to improve cash flow management is by keeping personal and business finances separate. This will help you get a clearer picture of the business’s financial health, track expenses more accurately, and avoid potential tax issues.

Pro Tip:

Working with an accounting professional ensures that your business finances are properly structured, and you’ll have a better understanding of your cash flow. Proper accounting practices also prepare you for tax season and ensure you’re maximizing deductions.

6. Build Cash Reserves for Emergencies

A healthy cash reserve acts as a buffer for times when cash flow is inconsistent. Aim to build an emergency fund that covers at least 3 to 6 months of operational expenses. This will give you the flexibility to handle downturns without resorting to loans or credit.

Pro Tip:

Tax planning services can help you identify ways to optimize your profits, which can be directed into a cash reserve. By minimizing your tax liability, you free up more cash for saving and investing in your business.

Conclusion: Ensuring Business Continuity Through Strong Cash Flow Management

Cash flow is essential for business survival and growth. By addressing the common cash flow management challenges that small businesses face, you can create a more stable and sustainable financial foundation. Outsourcing accounting services, utilizing bookkeeping services, and engaging in proactive tax planning services can significantly improve your cash flow management efforts.

Just as tackling marketing strategy difficulties can help improve customer acquisition and retention, addressing cash flow challenges ensures your business has the financial resources to implement and execute these strategies effectively. With the right approach, your business will not only overcome cash flow hurdles but also set the stage for long-term success.