Technology Adoption Barriers: Overcoming Challenges for Small Businesses

In today’s fast-paced digital world, technology adoption is essential for small businesses to stay competitive, increase productivity, and improve customer service. However, despite the numerous benefits that technology can offer, many small businesses struggle to integrate new technologies into their operations. The barriers to technology adoption can be complex, ranging from financial limitations to resistance to change within the organization.

In this article, we’ll explore the common technology adoption barriers faced by small businesses and offer solutions to overcome these challenges. Additionally, we’ll discuss how integrating accounting services, bookkeeping services, and tax planning services can help smooth the transition to new technologies and support ongoing digital transformation.

If you’re dealing with marketing strategy difficulties or cash flow management challenges, embracing the right technology can significantly enhance your efforts. By adopting innovative tools, your business can not only overcome these barriers but also position itself for sustainable growth and success.

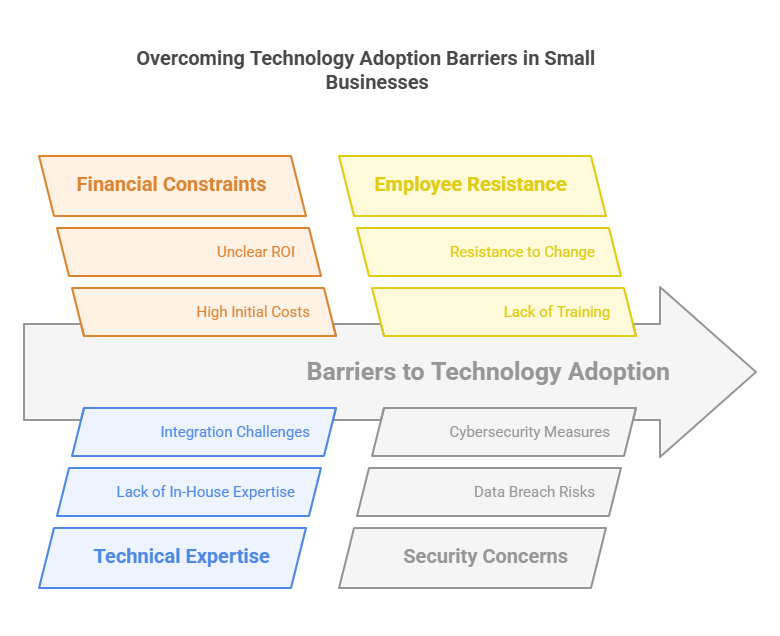

Common Technology Adoption Barriers for Small Businesses

Small businesses face several obstacles when it comes to adopting new technologies. Identifying and addressing these barriers is crucial for ensuring that your business can leverage the latest tools to streamline operations and stay ahead of the competition.

1. High Initial Costs of Technology Implementation

One of the most significant barriers to technology adoption is the high upfront cost of purchasing and implementing new technologies. Small businesses often have limited budgets and may find it difficult to justify the initial investment, especially when the return on investment (ROI) is not immediately clear.

Impact on the Business:

Without the necessary budget, businesses may delay adopting essential technologies or opt for outdated systems that hinder their growth. This can lead to inefficiencies, reduced productivity, and missed opportunities to improve customer experience.

2. Lack of Technical Expertise

Many small businesses do not have in-house technical expertise to implement and maintain new technologies. Whether it’s integrating new software, setting up cloud-based systems, or maintaining cybersecurity measures, the lack of knowledge and skills can make it difficult to adopt technology successfully.

Impact on the Business:

Without the necessary technical knowledge, businesses may struggle to use new technologies effectively. This can result in wasted resources, operational inefficiencies, and even security vulnerabilities, all of which undermine business success.

3. Resistance to Change from Employees

Resistance to change is a common barrier in any organization, especially when it comes to adopting new technology. Employees may be hesitant to learn new systems, fearing that it will disrupt their workflows or require extra effort to learn unfamiliar tools. This resistance can prevent the full adoption of technology within the business.

Impact on the Business:

When employees are not on board with new technology, it can slow down the implementation process and reduce the effectiveness of the technology. Low employee engagement with new systems can lead to poor adoption rates and underutilized resources.

4. Concerns About Data Security

As businesses adopt more digital tools, they face increased concerns about data security. Small businesses may worry about the potential risks of data breaches, hacking, or loss of customer information. These concerns can make businesses hesitant to invest in cloud services, customer relationship management (CRM) tools, or other online platforms.

Impact on the Business:

Failure to adopt secure technologies can expose small businesses to significant risks, including financial loss, legal issues, and damage to their reputation. It’s essential for businesses to prioritize cybersecurity measures when adopting new technologies.

5. Integration with Existing Systems

Integrating new technology with existing systems can be a complex process. Small businesses may already have legacy systems in place, and the idea of integrating new tools with these older systems can be daunting. The complexity of integration often discourages businesses from pursuing digital transformation.

Impact on the Business:

Poor integration can lead to data silos, inefficiencies, and duplication of work. If new technology doesn’t seamlessly work with existing systems, businesses may face delays and disruptions that affect their overall operations.

6. Lack of Clear ROI and Business Case

For many small businesses, it can be difficult to see the clear ROI from investing in new technology. Without a concrete understanding of how a particular technology will benefit the business, small business owners may hesitate to adopt it. This lack of clarity can prevent businesses from taking the leap toward digital transformation.

Impact on the Business:

When small businesses don’t see the value in adopting technology, they may miss out on opportunities for efficiency gains, customer satisfaction improvements, and long-term growth. Without a clear business case, businesses may choose to delay or forgo technology adoption altogether.

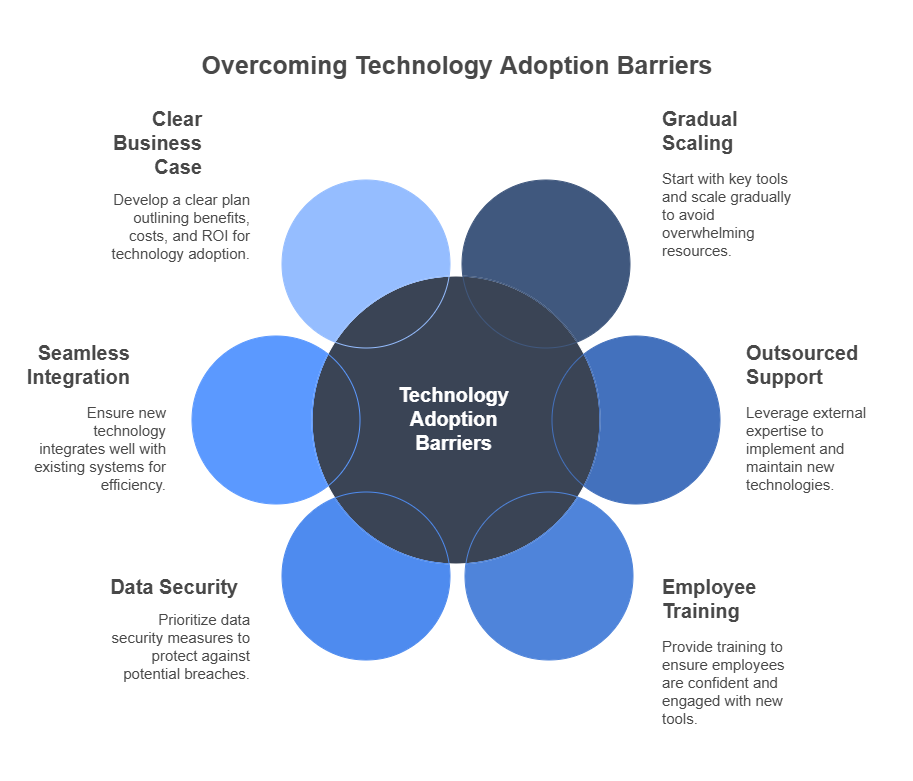

How to Overcome Technology Adoption Barriers

While technology adoption barriers are real, they are not insurmountable. Small businesses can overcome these challenges with the right strategies in place. Let’s explore some practical solutions to help small businesses successfully implement new technologies.

1. Start Small and Scale Gradually

Rather than investing heavily in multiple technologies at once, small businesses should start with one or two key tools that offer the most immediate benefit. By beginning with small, manageable projects, businesses can gain confidence and experience in using new technology without overwhelming their resources.

Pro Tip:

Accounting services can help small businesses streamline their financial processes, making it easier to allocate funds for technology investment. By having a clear understanding of your financial position, you can prioritize technology adoption that aligns with your business goals.

2. Leverage Outsourced Technical Support

If your business lacks in-house technical expertise, consider outsourcing technical support or working with a managed service provider (MSP) to implement and maintain new technologies. Outsourcing can provide the necessary expertise without the cost of hiring full-time IT staff.

Pro Tip:

Outsourcing bookkeeping services can free up your time and resources, allowing you to focus on more critical aspects of your business, such as technology adoption. A streamlined financial process can make it easier to allocate funds for digital tools and IT support.

3. Provide Employee Training and Support

Employee buy-in is essential for successful technology adoption. Provide adequate training and support to ensure that your team feels confident using new tools. Offering training sessions, resources, and ongoing assistance can help employees feel more comfortable and engaged with the technology.

Pro Tip:

Investing in training programs or courses for employees can enhance their skills and increase the likelihood of successful technology adoption. It’s important to foster a culture of continuous learning and adaptability within your business.

4. Prioritize Data Security Measures

Data security should be a top priority when adopting new technology. Work with cybersecurity experts to ensure that your systems are protected from potential breaches. Choose technologies that offer robust security features, and educate employees about best practices for safeguarding sensitive data.

Pro Tip:

Utilizing tax planning services can help businesses understand the financial implications of data security measures and invest in technologies that meet compliance and security standards.

5. Focus on Seamless Integration

When adopting new technology, ensure that it integrates well with your existing systems. Look for tools and software that offer easy integration options with your current infrastructure. A well-integrated system will reduce operational disruptions and improve overall efficiency.

Pro Tip:

Bookkeeping services can help you ensure that your financial data is organized and accessible across systems, making it easier to integrate new tools for improved financial management.

6. Develop a Clear Business Case for Technology

Before implementing any technology, develop a clear business case that outlines the expected benefits, costs, and ROI. Demonstrating the value of technology adoption will help you gain internal support and justify the investment. Having a solid plan in place will also ensure that the technology aligns with your business objectives.

Pro Tip:

Work with accounting services to assess your current financial situation and determine how technology investments can drive efficiency and profitability in the long run. A clear understanding of your cash flow and financial goals will help you make informed decisions about technology adoption.

Conclusion: Embrace Technology for Business Growth and Efficiency

Technology adoption is crucial for small businesses looking to grow, improve efficiency, and stay competitive. While there are many barriers to adoption, these challenges can be overcome with the right strategies in place. By starting small, investing in training, prioritizing data security, and integrating new technologies with existing systems, small businesses can successfully navigate the digital transformation process.

Incorporating accounting services, bookkeeping services, and tax planning services into your technology strategy will help streamline operations, improve financial management, and ensure a smooth transition to new tools. With the right approach, your business can overcome technology adoption barriers and thrive in an increasingly digital world.

By addressing marketing strategy difficulties, cash flow management challenges, and now technology adoption barriers, your small business will be well-equipped to overcome common obstacles and position itself for sustainable growth.