Financial reporting services are professional solutions that help businesses prepare, analyze, and present financial statements and reports. These services ensure that your company’s financial data is accurate, compliant with regulations, and useful for decision-making.

What Does Financial Reporting Mean?

At its core, financial reporting involves creating formal records of a company’s financial activities. These reports include key documents such as:

- Income Statement (Profit & Loss)

- Balance Sheet (Assets, Liabilities, and Equity)

- Cash Flow Statement (Money Inflows and Outflows)

Financial reporting helps stakeholders — including business owners, investors, and regulators — understand the financial health of your company.

Why Are Financial Reporting Services Important?

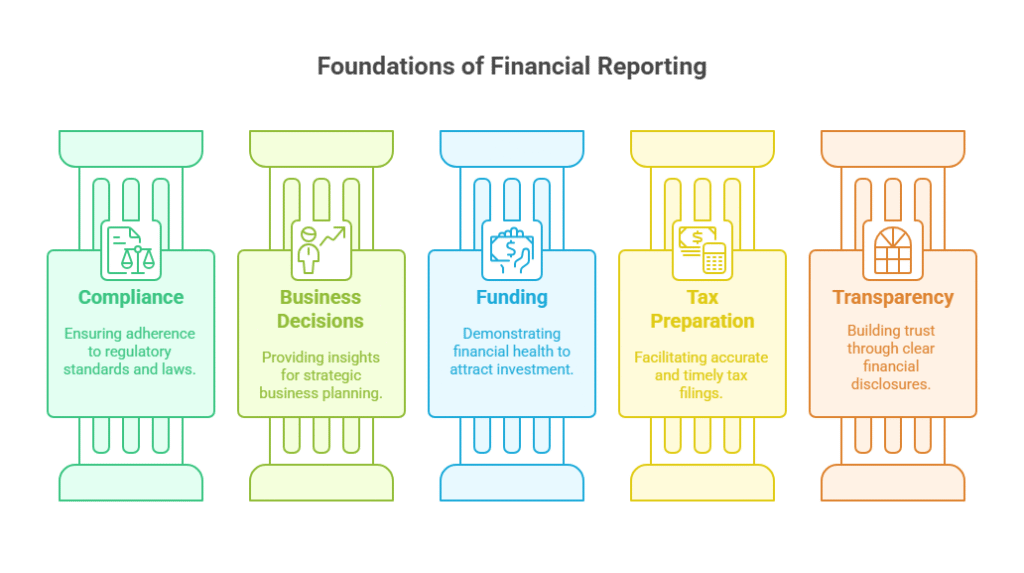

Accurate financial reports are essential for:

- Compliance: Meeting regulatory requirements like GAAP (Generally Accepted Accounting Principles) or IRS rules.

- Business Decisions: Providing actionable insights to improve profitability and growth.

- Funding: Demonstrating financial stability to banks, investors, or lenders.

- Tax Preparation: Ensuring correct and timely tax filings.

- Transparency: Building trust with stakeholders through clear financial disclosure.

What Do Financial Reporting Services Include?

A reliable financial reporting service typically offers:

- Preparation of monthly, quarterly, and annual financial statements.

- Custom financial reports tailored to your business needs.

- Regulatory compliance checks.

- Data analysis to identify trends and risks.

- Integration with accounting software for automation.

- Expert consultation to interpret financial data.

Using financial reporting services frees up time for you to focus on running your business while ensuring your finances are in expert hands.

Who Needs Financial Reporting Services?

- Small and Medium Businesses (SMBs): To keep books accurate and reports compliant.

- Startups: For investor presentations and financial planning.

- Nonprofits: To maintain transparency and fulfill grant requirements.

- Corporations: To comply with SEC and other regulatory bodies.

- Freelancers & Consultants: To manage income and expenses efficiently.

How to Choose the Right Financial Reporting Services Provider?

Look for a provider that offers:

- Expertise in GAAP and IFRS standards.

- Experience with your business size and industry.

- Use of modern financial reporting software and automation.

- Strong customer support and transparent pricing.

- Proven track record with positive client testimonials.

Financial Reporting Services and Technology in 2025

Financial reporting is evolving rapidly with the integration of AI and cloud-based platforms. Today’s services often include:

- Real-time financial dashboards.

- Automated error detection.

- Predictive financial analytics.

- Secure data storage and easy collaboration.

Partnering with a forward-thinking financial reporting services provider ensures you stay ahead of these trends and maintain a competitive edge.

Summary: Why Invest in Financial Reporting Services?

Investing in professional financial reporting services helps your business:

- Stay compliant with evolving regulations.

- Make smarter, data-driven decisions.

- Save time and reduce errors.

- Present transparent and trustworthy financial information to stakeholders.

For any growing business in the USA, the services offered by Smart Accountants are not just a luxury — they’re a necessity.

FAQs About Financial Reporting Services

Q1: What is the difference between bookkeeping and financial reporting services?

Bookkeeping records daily transactions, while financial reporting summarizes this data into meaningful reports.

Q2: How often should financial reports be prepared?

Typically monthly or quarterly, but some businesses require real-time reporting.

Q3: Are financial reporting services expensive?

Costs vary by provider and service complexity; many offer scalable solutions for small businesses.

Q4: Can financial reporting services help with tax audits?

Yes, detailed and accurate reports make audit processes smoother.

Q5: Is cloud technology safe for financial reporting?

Reputable providers use encrypted cloud platforms that meet strict security standards.