Preparing financial reports for tax season is one of the most critical tasks for any business. Accurate financial reporting services ensure you comply with IRS regulations, avoid penalties, and optimize your tax filings.

What Financial Reports Are Needed for Tax Season?

During tax season, businesses typically need:

- Profit and Loss Statement — shows revenue and expenses.

- Balance Sheet — details assets, liabilities, and equity.

- Cash Flow Statement — tracks cash inflows and outflows.

- Tax-Specific Reports — such as Schedule C for sole proprietors.

These reports form the basis for your tax return and are often required by accountants or tax professionals.

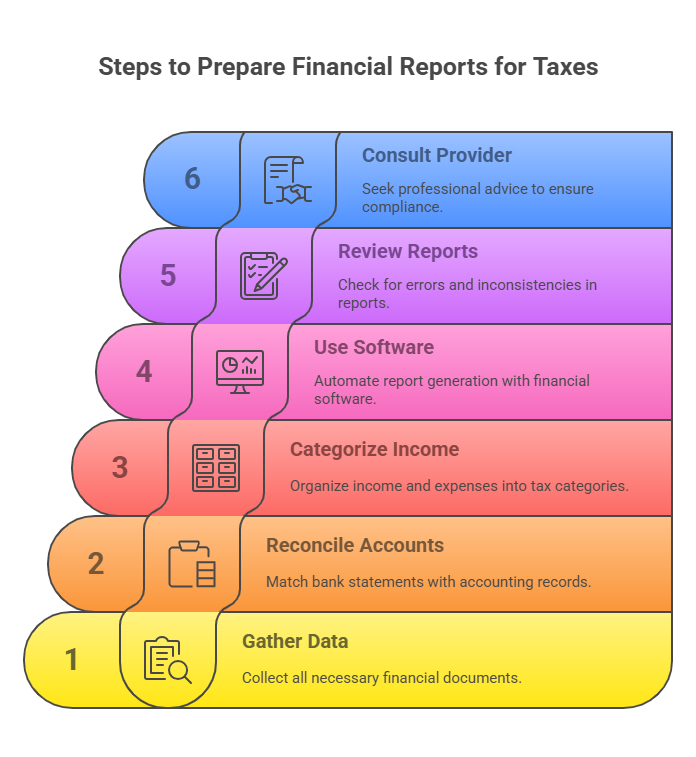

Step-by-Step Guide to Prepare Financial Reports for Taxes

1. Gather All Financial Data

Collect invoices, receipts, bank statements, payroll data, and previous tax filings.

2. Reconcile Your Accounts

Match bank statements with your accounting records to ensure accuracy.

3. Categorize Income and Expenses Properly

Ensure everything is recorded under the correct tax categories to maximize deductions.

4. Use Reliable Financial Reporting Software

Automate report generation to reduce human error and save time.

5. Review Reports for Accuracy

Check for inconsistencies or missing transactions.

6. Consult Your Financial Reporting Services Provider

Professional services can audit and verify your reports to meet tax compliance.

Why Use Professional Financial Reporting Services for Tax Preparation?

- Expertise in IRS Requirements: Helps you avoid costly mistakes.

- Time-Saving: Focus on running your business while experts handle reporting.

- Audit Readiness: Detailed and compliant reports make audits less stressful.

- Up-to-Date with Tax Laws: Ensure your reports reflect the latest IRS rules.

If you want to understand more about what financial reporting services encompass, check out our What Are Financial Reporting Services? guide.

Common Mistakes to Avoid When Preparing Tax Financial Reports

- Missing receipts or documentation.

- Incorrect categorization of expenses.

- Failing to reconcile accounts.

- Not updating reports before filing.

- Ignoring changes in tax laws.

How Often Should You Update Financial Reports During the Year?

It’s best practice to update financial reports monthly or quarterly, not just during tax season. This approach reduces year-end stress and improves decision-making throughout the year.

For a detailed explanation of why frequent reporting matters, visit our Financial Reporting Services Overview.

The Role of Technology in Financial Reporting for Tax Season

Modern financial reporting software offers:

- Automated report generation.

- Integration with tax software.

- Real-time data updates.

- Secure cloud access.

Choosing a service provider that uses these technologies ensures smooth tax preparation and compliance.

Summary: Make Tax Season Easier with Accurate Financial Reporting

At Smart Accountants, we understand that accurate financial reports are the backbone of a smooth tax season. Leveraging our professional financial reporting services helps you stay compliant, save time, and avoid costly mistakes.

FAQs About Financial Reports for Tax Season

Q1: Can I prepare financial reports for taxes myself?

Yes, but professional services reduce errors and save time.

Q2: What happens if financial reports are inaccurate during tax filing?

You risk audits, penalties, and fines.

Q3: How can financial reporting services help during an IRS audit?

They provide detailed documentation and support.

Q4: Are there special reports needed for different business types?

Yes, reports vary for sole proprietors, LLCs, corporations, etc.

Q5: How soon should I start preparing reports before tax deadlines?

Start at least 1-2 months before to allow time for review.